Effective risk management is crucial for success in any endeavor. Risk management tools enable organizations to anticipate and mitigate potential problems, minimizing their impact and maximizing opportunities. By identifying and assessing risks, businesses can develop strategies to reduce their likelihood and consequences. This proactive approach helps to protect assets, ensure continuity, and drive growth. With the right risk management tools, organizations can navigate uncertainty with confidence, make informed decisions, and achieve their objectives. Implementing these tools is essential for building resilience and achieving long-term success in an increasingly complex and uncertain world.

As we delve into the realm of risk management, it’s essential to understand the importance of anticipating and mitigating potential problems. This is where risk management tools come into play, helping us to identify, assess, and prioritize risks.

Introduction to Risk Management Tools

Risk management tools are designed to help organizations identify, assess, and mitigate potential risks. These tools can be used in various contexts, including project management, financial management, and operational management. By utilizing these tools, organizations can reduce the likelihood and impact of adverse events, thereby protecting their assets, reputation, and bottom line.

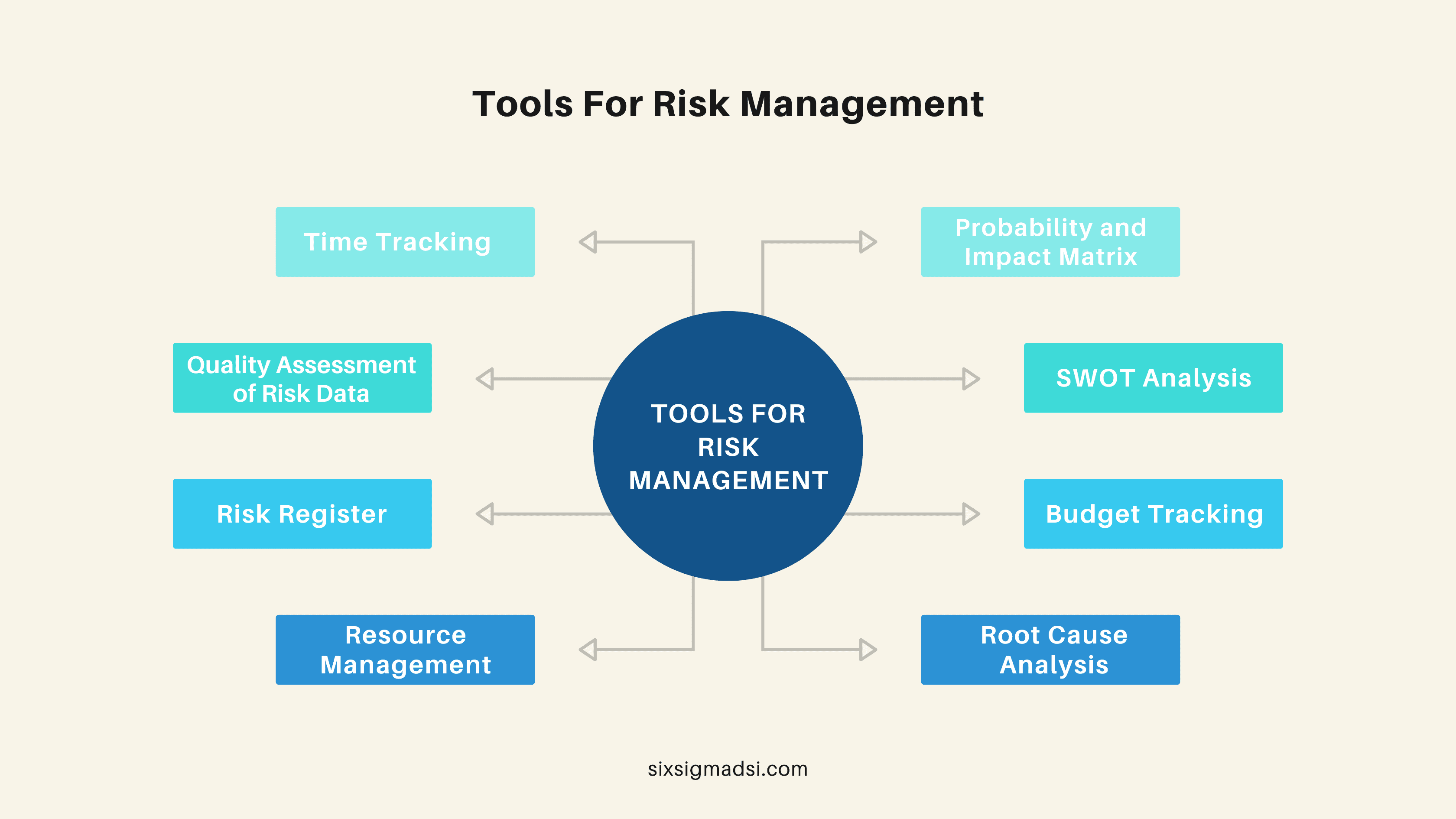

Types of Risk Management Tools

There are several types of risk management tools available, including risk assessment templates, decision trees, and sensitivity analysis. These tools can be used to identify and assess potential risks, prioritize them based on their likelihood and impact, and develop strategies to mitigate them. For instance, a risk matrix can be used to categorize risks based on their likelihood and impact, allowing organizations to focus on the most critical ones.

Risk Management Process

The risk management process involves several stages, including risk identification, risk assessment, risk prioritization, and risk mitigation. By following this process, organizations can ensure that they are taking a proactive and structured approach to managing risks. It’s essential to note that risk management is an ongoing process that requires continuous monitoring and review.

Benefits of Risk Management Tools

The use of risk management tools can bring numerous benefits to organizations, including improved decision-making, reduced risk exposure, and enhanced compliance. By using these tools, organizations can make informed decisions, minimize the likelihood and impact of adverse events, and ensure that they are complying with relevant laws and regulations.

Best Practices for Implementing Risk Management Tools

To get the most out of risk management tools, organizations should follow best practices such as establishing clear risk management policies, providing training and support, and continuously monitoring and reviewing the effectiveness of these tools. By doing so, organizations can ensure that they are using these tools effectively and efficiently, thereby maximizing their benefits.

| Risk Management Tool | Description | Benefits |

|---|---|---|

| Risk Assessment Template | A document used to identify and assess potential risks | Helps organizations identify and prioritize risks |

| Decision Tree | A visual representation of possible outcomes and decisions | Enables organizations to evaluate different scenarios and make informed decisions |

| Sensitivity Analysis | A technique used to analyze how different variables affect outcomes | Helps organizations understand the potential impact of different risks and develop strategies to mitigate them |

By utilizing these risk management tools and following best practices, organizations can anticipate and mitigate problems, thereby protecting their assets, reputation, and bottom line. The key is to identify, assess, and prioritize potential risks, and develop strategies to mitigate them.

What are the main tools used for risk management?

The main tools used for risk management are designed to identify, assess, prioritize, and mitigate potential risks. These tools can be categorized into several key areas, each serving a distinct purpose in the overall risk management process. Effective risk management requires a combination of these tools to ensure comprehensive coverage of potential risks.

Introduction to Risk Management Tools

The introduction to risk management tools begins with understanding the basics of risk assessment, which involves identifying and evaluating potential risks. This process is crucial for determining the likelihood and impact of risks, allowing organizations to prioritize their efforts. Key tools in this initial phase include risk matrices, which help in visualizing and prioritizing risks based on their likelihood and potential impact. The following are some of the primary tools used:

- Risk Registers to document and track risks.

- Sensitivity Analysis to understand the impact of changes in variables.

- Scenario Planning to imagine and prepare for potential future events.

Quantitative Risk Management Tools

Quantitative risk management tools are used to assign numerical values to risks, allowing for a more precise assessment of their potential impact. These tools are essential for financial risk management, where the potential financial loss from a risk can be quantified. Simulation models, such as Monte Carlo simulations, are commonly used to estimate the potential outcomes of different scenarios. Key aspects of quantitative risk management include:

- Probability Distribution to model the likelihood of different outcomes.

- Decision Trees to visually represent different courses of action and their potential outcomes.

- Expected Monetary Value (EMV) to calculate the average outcome of different scenarios.

Qualitative Risk Management Tools

Qualitative risk management tools focus on the non-numerical aspects of risk, such as the risk management culture within an organization and the communication of risk. These tools are vital for understanding and addressing risks that are difficult to quantify, such as reputational risk or compliance risks. Swot Analysis, which identifies strengths, weaknesses, opportunities, and threats, is a key qualitative tool. Important qualitative risk management techniques include:

- Expert Judgment to leverage the experience and knowledge of experts in assessing risks.

- Delphi Technique to gather opinions from a group of experts without direct interaction.

- Brainstorming Sessions to generate a wide range of ideas about potential risks and their mitigation strategies.

What are the 4 types of risk mitigation?

The 4 types of risk mitigation are essential for businesses and organizations to manage and reduce potential risks. These types include risk avoidance, risk transfer, risk reduction, and risk acceptance. Each type has its own unique approach to handling risks, and understanding them is crucial for effective risk management.

Understanding Risk Avoidance

Risk avoidance is a type of risk mitigation that involves eliminating or avoiding the risk altogether. This can be done by not engaging in activities that pose a risk or by terminating a project or operation that is deemed too risky. For example, a company may decide not to launch a new product in a certain market due to regulatory risks or market risks. The key benefits of risk avoidance include:

- Elimination of potential financial losses

- Reduction of legal liabilities

- Protection of reputation and brand image

Implementing Risk Transfer

Risk transfer involves shifting the risk to another party, such as an insurance company or a contractor. This can be done through insurance policies, contracts, or partnerships. For instance, a company may purchase cyber insurance to transfer the risk of cyber attacks to an insurance provider. The key advantages of risk transfer include:

- Cost savings through reduced risk management expenses

- Access to expertise and resources from the transfer partner

- Reduced financial exposure to potential risks

Practicing Risk Reduction and Acceptance

Risk reduction involves taking steps to minimize the likelihood or impact of a risk, while risk acceptance involves acknowledging and accepting the risk as it is. Risk reduction strategies include training employees, implementing safety protocols, and investing in technology to reduce the risk of accidents or security breaches. Risk acceptance may involve monitoring and reviewing the risk regularly to ensure it does not escalate. The key benefits of risk reduction and acceptance include:

- Improved resilience to potential risks and disruptions

- Enhanced risk awareness and preparedness among employees

- Optimized resource allocation to manage and reduce risks

What are two management tools used to mitigate your assigned risk?

Two management tools used to mitigate assigned risk are Risk Assessment and Contingency Planning. These tools help organizations identify potential risks, analyze their likelihood and impact, and develop strategies to mitigate or avoid them.

Identifying and Analyzing Risk

Identifying and analyzing risk is a crucial step in mitigating assigned risk. This involves identifying potential risks, analyzing their likelihood and impact, and determining the level of risk. To do this, organizations can use a variety of techniques, such as:

- Brainstorming: gathering a team of experts to identify potential risks and their causes

- SWOT analysis: identifying Strengths, Weaknesses, Opportunities, and Threats that may impact the organization

- Root cause analysis: identifying the underlying causes of potential risks and developing strategies to address them

Developing a Risk Mitigation Plan

Developing a risk mitigation plan is essential to mitigating assigned risk. This involves developing strategies to mitigate or avoid identified risks, assigning responsibilities to team members, and establishing timelines for implementation. To do this, organizations can use a variety of techniques, such as:

- Risk prioritization: prioritizing risks based on their likelihood and impact, and focusing on the most critical ones first

- Contingency planning: developing backup plans and emergency procedures to respond to potential risks

- Resource allocation: allocating resources and budget to support risk mitigation efforts

Monitoring and Reviewing Risk Mitigation Efforts

Monitoring and reviewing risk mitigation efforts is critical to ensuring that assigned risk is properly mitigated. This involves tracking progress, identifying new risks, and adjusting strategies as needed. To do this, organizations can use a variety of techniques, such as:

- Regular risk assessments: conducting regular risk assessments to identify new risks and assess the effectiveness of mitigation strategies

- Performance metrics: establishing performance metrics to measure the effectiveness of risk mitigation efforts

- Continuous improvement: continuously reviewing and improving risk mitigation strategies to ensure they remain effective

Frequently Asked Questions

What are the key components of risk management tools?

Risk management tools are designed to help organizations anticipate and mitigate problems by identifying and assessing potential risks. The key components of these tools include risk identification, risk assessment, risk prioritization, and risk mitigation strategies. These components work together to provide a comprehensive framework for managing risks, allowing organizations to minimize the likelihood and impact of potential problems. By using risk management tools, organizations can proactively address potential risks, reducing the likelihood of unforeseen issues and financial losses. Effective risk management tools also enable organizations to allocate resources more efficiently, optimize their operations, and improve their overall performance.

How do risk management tools help organizations anticipate problems?

Risk management tools help organizations anticipate problems by providing a systematic approach to identifying and assessing potential risks. These tools use data analytics and statistical models to identify patterns and trends that may indicate potential risks. By analyzing historical data and industry trends, organizations can anticipate potential problems and take proactive measures to mitigate them. Risk management tools also enable organizations to simulate different scenarios, allowing them to predict the potential impact of various risks and develop strategies to address them. Additionally, these tools facilitate collaboration and communication among stakeholders, ensuring that all parties are aware of potential risks and are working together to mitigate them.

What are some common risk management tools used by organizations?

There are several common risk management tools used by organizations, including risk assessment software, project management tools, and business continuity planning software. These tools provide a range of features, such as risk identification, risk prioritization, and mitigation strategies, to help organizations manage risks. Other common risk management tools include SWOT analysis, decision trees, and sensitivity analysis. These tools enable organizations to analyze and evaluate potential risks, develop strategies to mitigate them, and monitor their effectiveness. By using these tools, organizations can improve their risk management capabilities, reduce the likelihood of unforeseen issues, and enhance their overall performance.

How can organizations effectively implement risk management tools?

To effectively implement risk management tools, organizations should establish a clear risk management framework that outlines their approach to identifying, assessing, and mitigating risks. This framework should include defined roles and responsibilities, standardized processes, and established metrics for measuring risk. Organizations should also train their employees on the use of risk management tools and ensure that they have the necessary skills and knowledge to effectively manage risks. Additionally, organizations should regularly review and update their risk management tools to ensure that they remain effective and relevant. By implementing risk management tools in a systematic and structured manner, organizations can maximize their benefits and minimize the likelihood of unforeseen issues.