Electronic invoicing software has revolutionized the way businesses manage their tax processes, making it easier and more efficient. With this innovative solution, companies can automate and streamline their invoicing, reducing the risk of errors and saving time. By simplifying tax processes, businesses can focus on growth and development, rather than getting bogged down in paperwork. In this article, we will explore the benefits and features of electronic invoicing software, and how it can transform the way you handle your tax obligations, making it a game-changer for businesses of all sizes and industries, every day.

When it comes to managing tax processes, electronic invoicing software can be a game-changer. This type of software is designed to simplify and streamline the invoicing process, making it easier to manage tax compliance and reduce the risk of errors. Here are some key benefits of using electronic invoicing software:

What is Electronic Invoicing Software?

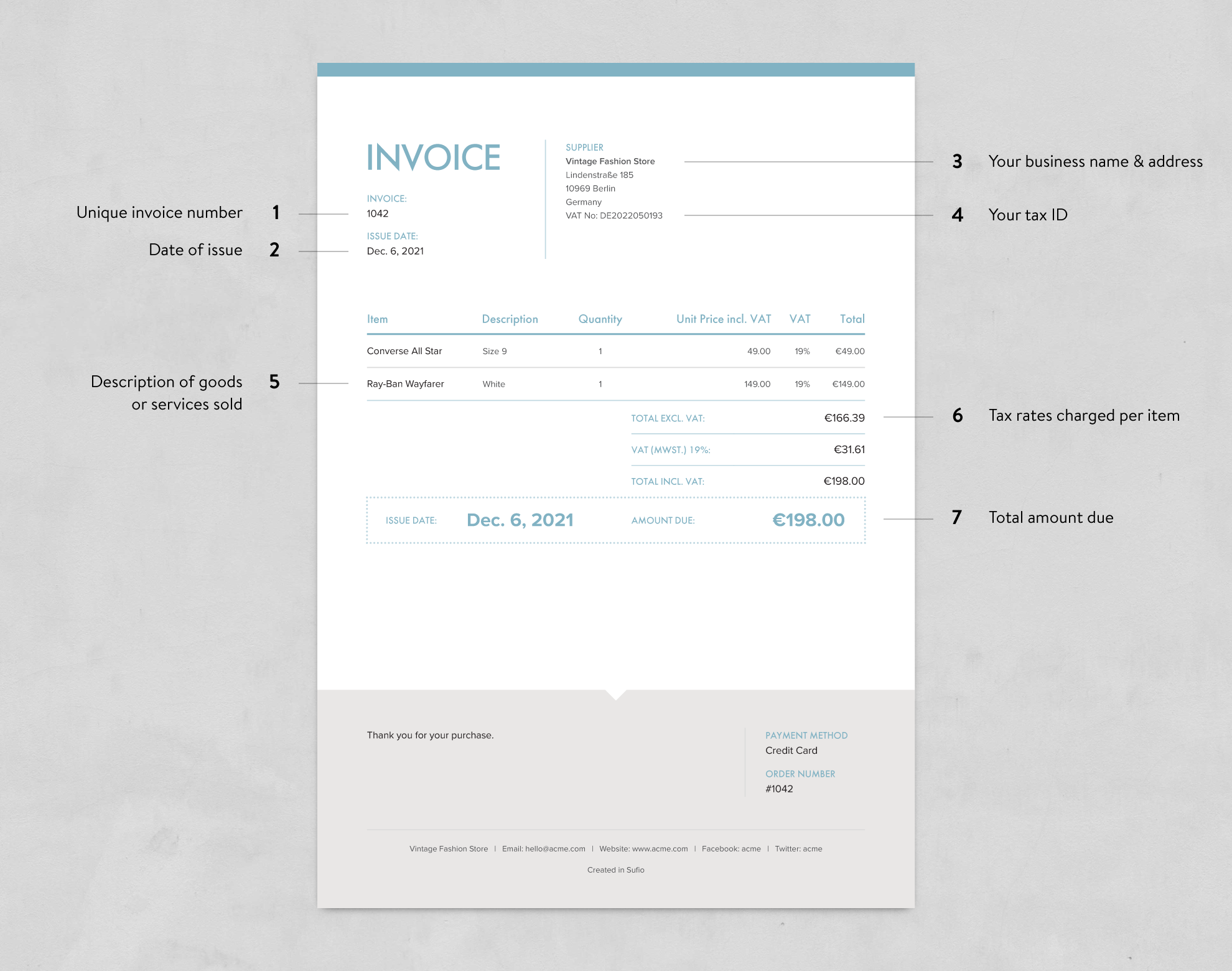

Electronic invoicing software is a type of digital tool that allows businesses to create, send, and manage electronic invoices. This software can help automate the invoicing process, reducing the need for manual data entry and minimizing the risk of errors. With electronic invoicing software, businesses can easily track invoice status, send reminders, and generate reports.

Benefits of Electronic Invoicing Software

The benefits of electronic invoicing software are numerous. For one, it can help businesses save time and money by reducing the need for paper-based invoicing. Electronic invoicing software can also help improve cash flow by allowing businesses to send invoices and receipts electronically, reducing the time it takes to get paid. Additionally, electronic invoicing software can help businesses improve tax compliance by providing accurate and up-to-date records of invoice and payment data.

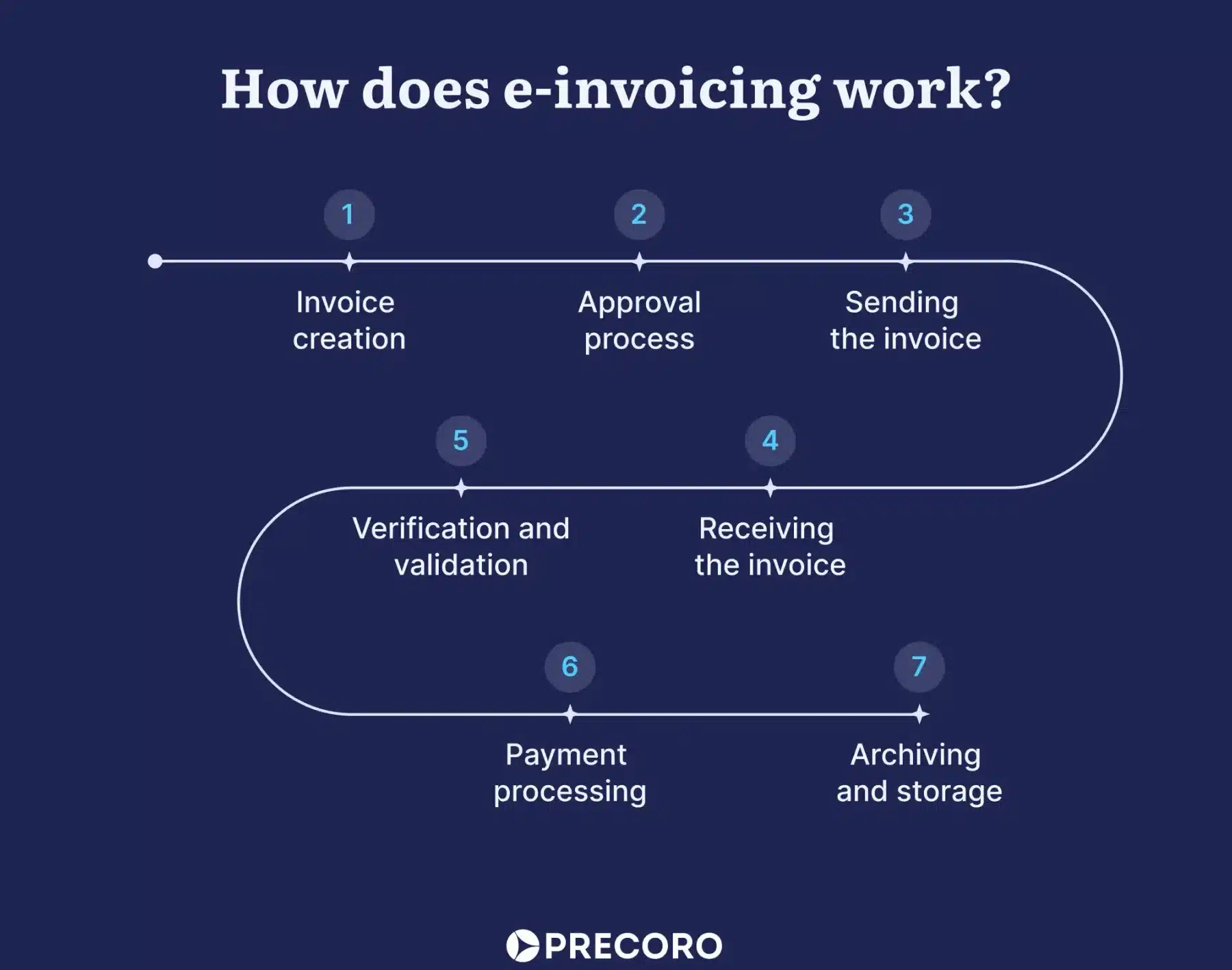

How Electronic Invoicing Software Works

Electronic invoicing software typically works by allowing businesses to create and send electronic invoices to customers via email or online portal. The software can also be integrated with accounting systems to automate the invoicing process and reduce the need for manual data entry. Once an invoice is sent, the software can track invoice status, send reminders, and generate reports to help businesses stay on top of their invoicing and payment processes.

Key Features of Electronic Invoicing Software

Some key features of electronic invoicing software include:

| Feature | Description |

|---|---|

| Automated Invoicing | Automates the invoicing process, reducing the need for manual data entry |

| Electronic Invoice Delivery | Allows businesses to send invoices electronically via email or online portal |

| Invoice Tracking | Tracks invoice status, including when an invoice is sent, viewed, and paid |

| Reporting and Analytics | Provides businesses with detailed reports and analytics on invoicing and payment data |

| Integration with Accounting Systems | Integrates with accounting systems to automate the invoicing process and reduce errors |

Best Practices for Implementing Electronic Invoicing Software

To get the most out of electronic invoicing software, businesses should follow best practices such as configuring the software to meet their specific needs, training staff on how to use the software, and monitoring and analyzing invoicing and payment data to identify areas for improvement. By following these best practices, businesses can ensure a smooth transition to electronic invoicing software and start experiencing the benefits of streamlined and automated invoicing processes.

What is a simplified e-invoice?

A simplified e-invoice is an electronic invoice that has been streamlined to reduce the complexity and costs associated with traditional invoicing methods. It is designed to be easy to use, understand, and implement, making it an attractive option for businesses of all sizes. The main goal of a simplified e-invoice is to facilitate faster payments, improved cash flow, and reduced administrative burdens.

Benefits of Simplified E-Invoices

The benefits of simplified e-invoices are numerous and can have a significant impact on a company’s bottom line. Some of the key advantages include:

- Increased efficiency: Simplified e-invoices automate many of the tasks associated with traditional invoicing, such as data entry and document processing.

- Improved accuracy: Electronic invoices reduce the risk of errors and discrepancies, ensuring that payments are made correctly and on time.

- Enhanced security: Simplified e-invoices often include encryption and other security measures to protect sensitive information and prevent fraud.

Key Features of Simplified E-Invoices

Simplified e-invoices typically include a range of features that make them easy to use and understand. Some of the key features include:

- Clear and concise formatting: Simplified e-invoices are designed to be easy to read and understand, with clear headings and concise language.

- Automated calculations: Electronic invoices can automatically calculate taxes, discounts, and other charges, reducing the risk of errors.

- Electronic payment options: Simplified e-invoices often include online payment options, making it easy for customers to pay their bills quickly and securely.

Implementing Simplified E-Invoices

Implementing simplified e-invoices can be a straightforward process, especially for businesses that already use electronic invoicing software. Some of the key steps involved in implementing simplified e-invoices include:

- Selecting a provider: Businesses need to select a reputable provider of e-invoicing solutions that meets their needs and budget.

- Configuring the system: The e-invoicing system needs to be configured to meet the business’s specific requirements, including invoice templates and payment options.

- Training staff: Staff need to be trained on how to use the new system, including how to create and send simplified e-invoices and manage payments.

What is the difference between tax invoice and simplified tax invoice?

The tax invoice and simplified tax invoice are two types of invoices used for different purposes. A tax invoice is a detailed invoice that contains all the necessary information about the transaction, including the date, invoice number, buyer’s and seller’s information, description of goods or services, quantity, rate, amount, and tax amount. On the other hand, a simplified tax invoice is a condensed version of the tax invoice, which contains only the essential information, such as the date, invoice number, description of goods or services, and amount.

Differences in Invoice Requirements

The main difference between a tax invoice and a simplified tax invoice lies in the level of detail required. A tax invoice requires more detailed information, such as the tax identification number, address, and contact information of the buyer and seller. In contrast, a simplified tax invoice requires less information, making it a more concise and straightforward document. The key differences in invoice requirements are:

- The tax invoice requires a detailed description of the goods or services, while the simplified tax invoice only requires a brief description.

- The tax invoice must include the tax amount and tax rate, whereas the simplified tax invoice only shows the total amount.

- The tax invoice is typically used for business-to-business transactions, while the simplified tax invoice is used for business-to-consumer transactions or for small-scale businesses.

Purpose and Usage

The tax invoice and simplified tax invoice serve different purposes and are used in different circumstances. A tax invoice is typically used for formal business transactions, where detailed documentation is required for tax purposes and accounting records. In contrast, a simplified tax invoice is used for informal transactions or small-scale businesses, where a detailed invoice is not necessary. The simplified tax invoice is often used for cash transactions or point-of-sale purchases, where a quick and easy invoice is required. The purpose and usage of these invoices are:

- The tax invoice is used to record business expenses and tax deductions, while the simplified tax invoice is used to record sales and revenue.

- The tax invoice is typically used for large-scale businesses, while the simplified tax invoice is used for small-scale businesses or individual entrepreneurs.

- The tax invoice requires official signatures and stamps, whereas the simplified tax invoice may not require these formalities.

Benefits and Drawbacks

Both tax invoices and simplified tax invoices have their own benefits and drawbacks. The tax invoice provides a detailed record of the transaction, which is useful for tax purposes and accounting records. However, it can be time-consuming and complex to prepare. On the other hand, the simplified tax invoice is quick and easy to prepare, but it may lack the detail required for formal business transactions. The benefits and drawbacks of these invoices are:

- The tax invoice provides a detailed record of the transaction, which can help with tax audits and financial reporting.

- The simplified tax invoice is quick and easy to prepare, which can save time and effort for small-scale businesses or individual entrepreneurs.

- The tax invoice can be complex and difficult to understand, especially for non-accountants, while the simplified tax invoice is often easier to understand and more straightforward.

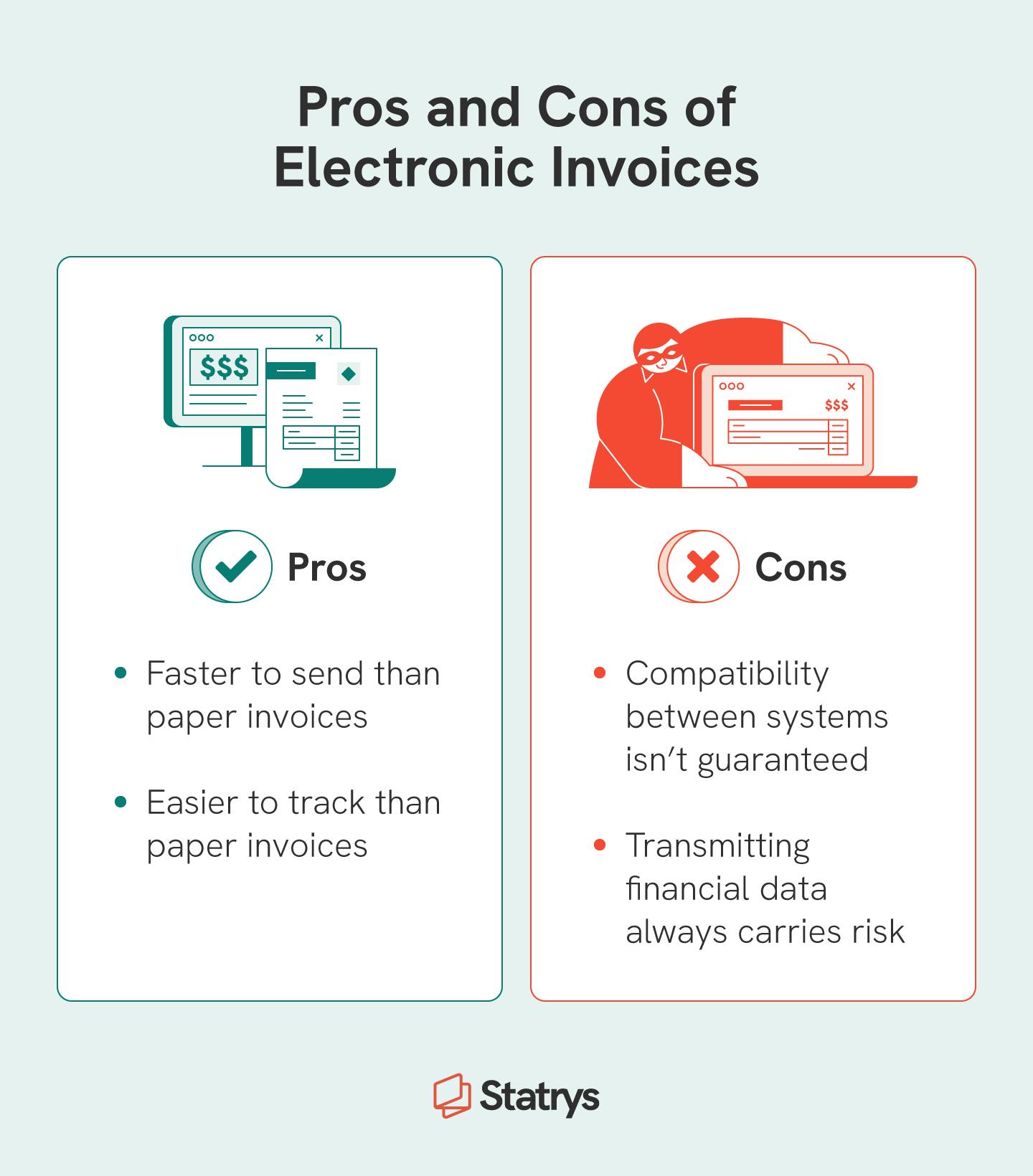

What are the disadvantages of e-invoicing?

The disadvantages of e-invoicing include several key points that need to be considered. While e-invoicing offers numerous benefits such as increased efficiency and reduced costs, it also has its drawbacks. One of the major disadvantages is the initial setup cost, which can be a significant burden for small businesses or individuals. Additionally, security concerns and technical issues can also arise, making it essential to weigh the pros and cons before implementing an e-invoicing system.

Technical Challenges

The technical challenges associated with e-invoicing can be a significant disadvantage. Implementing an e-invoicing system requires a certain level of technical expertise, which can be a barrier for some businesses. Some of the technical challenges include:

- Compatibility issues with different software and systems

- Integration problems with existing accounting systems

- Data security concerns and the need for robust encryption methods

These technical challenges can be time-consuming and costly to resolve, making it essential to carefully evaluate the technical requirements before implementing an e-invoicing system.

Security Risks

The security risks associated with e-invoicing are another significant disadvantage. As with any online system, e-invoicing is vulnerable to cyber-attacks and data breaches. Some of the security risks include:

- Phishing attacks and email scams that can trick users into revealing sensitive information

- Malware and viruses that can compromise the security of the system

- Unauthorized access to sensitive financial information

To mitigate these risks, it is essential to implement robust security measures, such as two-factor authentication and regular software updates.

Compliance Issues

The compliance issues associated with e-invoicing are another disadvantage that needs to be considered. E-invoicing systems must comply with regulatory requirements, such as tax laws and data protection regulations. Some of the compliance issues include:

- Tax compliance and the need to ensure that e-invoices meet tax authority requirements

- Data protection and the need to ensure that sensitive financial information is securely stored and transmitted

- Audit trail and the need to maintain a clear and transparent record of all financial transactions

To ensure compliance with regulatory requirements, it is essential to carefully evaluate the compliance requirements and implement robust controls to mitigate the risk of non-compliance.

What is the e-invoicing process?

The e-invoicing process refers to the electronic exchange of invoices between a supplier and a buyer through an automated system. This process eliminates the need for paper-based invoices, reducing errors and increasing efficiency. E-invoicing involves the creation, submission, and processing of electronic invoices, which are then stored and retrieved electronically.

E-Invoicing Benefits

The e-invoicing process offers numerous benefits, including improved accuracy, reduced processing time, and increased security. Some of the key advantages of e-invoicing include:

- Enhanced compliance with regulatory requirements

- Improved cash flow management through faster payment processing

- Reduced manual errors and increased productivity

E-Invoicing Implementation

Implementing an e-invoicing system requires careful planning and integration with existing accounting and financial systems. The process involves setting up an electronic invoicing platform, configuring workflow rules, and training staff on the new system. Some of the key considerations for e-invoicing implementation include:

- Choosing a suitable e-invoicing platform that meets business needs

- Ensuring compatibility with existing systems and software

- Establishing security protocols to protect sensitive financial data

E-Invoicing Formats and Standards

E-invoicing formats and standards vary depending on the country, industry, and business requirements. Some of the common e-invoicing formats include <strong/XML, EDIFACT, and PDF. To ensure seamless exchange of electronic invoices, businesses must adhere to standardized formatting guidelines and compliance regulations. Some of the key e-invoicing formats and standards include:

- XML-based invoicing for structured data exchange

- EDIFACT-based invoicing for international trade and commerce

- PDF-based invoicing for human-readable and non-structured data exchange

Frequently Asked Questions

What is electronic invoicing software and how does it work?

Electronic invoicing software is a digital solution that enables businesses to generate, send, and manage electronic invoices in a secure and efficient manner. This type of software is designed to streamline the invoicing process, reducing the need for paper-based invoices and minimizing the risk of errors and losses. With electronic invoicing software, businesses can create and send professional-looking invoices to their customers via email or online portals, and track the status of these invoices in real-time. The software can also automate tasks such as invoice reminders and payment notifications, making it easier for businesses to manage their cash flow and financial records. By using electronic invoicing software, businesses can save time and reduce costs, while also improving their overall financial management and compliance with tax regulations.

How can electronic invoicing software simplify my tax processes?

Electronic invoicing software can simplify tax processes in several ways. For one, it can help businesses accurately track their sales and expenses, making it easier to calculate their tax liabilities. The software can also automate the generation of tax reports and returns, reducing the risk of errors and penalties. Additionally, electronic invoicing software can integrate with accounting systems and tax authorities, enabling businesses to submit their tax returns electronically and receive instant confirmations. This can save time and reduce stress for businesses, while also improving their overall tax compliance and financial management. By using electronic invoicing software, businesses can also access real-time tax data and analyze their tax performance, enabling them to make informed decisions and optimize their tax strategies.

What are the benefits of using electronic invoicing software for my business?

The benefits of using electronic invoicing software for businesses are numerous. For one, it can improve cash flow by enabling businesses to send invoices quickly and receive payments faster. Electronic invoicing software can also reduce administrative costs by automating tasks such as invoice processing and payment tracking. Additionally, the software can enhance customer satisfaction by providing clear and professional-looking invoices, and improving communication through automated reminders and notifications. By using electronic invoicing software, businesses can also increase their productivity and efficiency, while reducing the risk of errors and disputes. Furthermore, electronic invoicing software can support sustainability and environmental initiatives by reducing paper waste and minimizing the carbon footprint of businesses.

Is electronic invoicing software secure and compliant with tax regulations?

Electronic invoicing software is designed to be secure and compliant with tax regulations. The software typically uses advanced encryption and security protocols to protect sensitive data, such as financial information and personal details. Additionally, electronic invoicing software is often certified by tax authorities and compliance organizations, ensuring that it meets the required standards for tax compliance and data security. The software can also generate audit trails and transaction records, providing businesses with a clear and transparent account of their financial activities. By using electronic invoicing software, businesses can ensure that their invoicing and tax processes are secure, compliant, and auditable, reducing the risk of penalties and fines. Moreover, electronic invoicing software can support real-time tax monitoring and reporting, enabling businesses to respond quickly to tax inquiries and audits.